You’ve Hit Capacity. Now What?

You built your business by saying yes to everything. Every detail. Every deadline. Every late night.

But now? You’re leading less and managing more.

BELAY’s eBook Delegate to Elevate pulls from over a decade of experience helping thousands of founders and executives hand off work — without losing control. Learn how top leaders reclaim their time, ditch the burnout, and step back into the role only they can fill: visionary.

It’s not just about scaling. It’s about getting back to leading.

The ceiling you’re feeling? Optional.

Highlights:

The global sports industry is valued at $417 billion in 2025 and is on pace to surpass $600 billion by 2030, fueled by 8%+ annual growth and record institutional capital flows.

Media rights revenue exceeds $57 billion this year, with technology platforms (Amazon, Apple, YouTube) now accounting for nearly $10 billion annually and driving a shift to direct-to-consumer models.

Private equity and sovereign wealth funds have invested more than $31 billion since 2023, with 30–40% institutional ownership in top leagues like the NBA, Premier League, and IPL.

Athlete and creator-led ventures now represent a $5B+ ecosystem, with individual stars and athlete-backed syndicates transforming both franchise value and media engagement.

Women’s sports, esports, and franchise cricket are the fastest-growing asset classes, with women’s league valuations above $2.7B and the combined cricket ecosystem exceeding $18B in 2025.

The industry now delivers 8–12% annual IRR for major franchises, while maintaining a low (0.08) correlation to public markets, cementing sports as a true alternative asset class.

Key risks include rising cost pressures, media rights fragmentation, PE/sovereign concentration, and regulatory scrutiny, especially outside Tier 1 leagues.

Africa, APAC, and MENA are now the next frontier for growth, investment, and risk, as the global sports capital stack expands and diversifies.

Contents:

Market Outlook

The global sports industry now stands at $417 billion, a number expected to top $600 billion by 2030, sustaining a robust 8% CAGR. This evolution is bigger than pure size: backed by over $65 billion in institutional capital flows since 2020, sports have matured from passion plays to engineered portfolio assets. Major deals, strategic exits, and fierce global capital allocation battles have decisively moved sports investment into the economic mainstream.

In 2024, annual consumer spending on sports hit an all-time high, with households averaging $1,122 globally on tickets, streaming, and gear.

The top 10 franchises/club sales now routinely register $3B+ transaction values, with premium soccer and NFL teams fetching upwards of $5B.

“Sport isn’t just entertainment, it’s infrastructure for attention”

1. Media Rights Inflation vs Saturation

Broadcast and streaming rights generate more than $57 billion globally in 2025, over 70% of major league revenues come from media alone. Tech and direct-to-consumer platforms (Amazon, Apple, YouTube) now account for nearly $10 billion in annualised rights value.

Financial highlights:

NFL signed a $110B, 11-year deal set a new high-water mark for global rights.

NBA follows with its $76B, 11-year deal.

The Olympic Games and Premier League maintained $6B and $4.8B cycles, respectively.

IPL’s $2.7B domestic/overseas rights confirmed cricket’s seat at the global money table.

Risks:

Platform churn is rising. U.S. sports subscriptions now average $39/month per household, with cancellations at a record 27% this year.

Only the top one-third of rights holders are seeing inflation-proof revenues; the rest face margin compression and bidding volatility.

North America and Europe account for over 60% of all global media rights spending but APAC and MENA are now adding $13B+ per year in new deal flow.

“Streaming isn’t a disruptor anymore, it’s the new stadium lease.”

2. Institutionalisation of Sports Capital

Across leagues and continents, the flow of private equity and sovereign investment is accelerating.

Key trends underpinning the new reality:

More than $31B in new PE/Venture flows since 2023; at least 1 in 3 clubs in major football leagues (EPL, La Liga, Serie A) now have an institutional owner or major minority backer.

NBA franchise values are up 232% since 2015, averaging $3.85B per club in 2025 (many underpinned by recent Arctos and Dyal HomeCourt syndications).

The “barbell” structure is real. High-valuation assets (NFL, EPL, IPL, F1) are buoyed by scarcity, while high-growth segments (esports, women’s, cricket T20) are attracting over $4B in annual new investment.

The new capital “stack”:

Secondary trades and recap deals now exceed $9B/year globally; exit multiples are approaching par with infrastructure funds, with 8–10 year holding periods becoming standard.

PE and sovereign-led club balance sheets are now routinely rated by international agencies, especially in Europe and North America, and stadium finance still draws $10B+ annually in new capital.

“The era of portfolio-grade sports is here, capital has caught up to fandom.”

3. Athlete & Brand Monetisation

Athlete-driven ownership, media, and VC has surged, amounting $5B in total deal volume across more than 250 structured athlete-led funds, syndicates, and clubs.

Recent shifts are reshaping both value and power:

Messi’s Inter Miami deal propelled the franchise valuation from $500M to $1.3B (+160%) in under a year.

Caitlin Clark is forecast to add over $40M to WNBA sponsorships and rights by year end.

Serena Ventures II, with $110M raised, has completed more than 20 investments in sports, health, and tech.

Athlete-creator “direct brand” ventures like Prime and Hana Kuma are on pace to drive between $400M and $1B in combined media and consumer revenues over the next three years.

Structural shifts:

Athlete-led ventures and syndicates routinely take minority stakes in major teams, including new NBA, NWSL, and IPL shareholdings.

In APAC and MENA, star-driven leagues and content channels account for over $900M/year in direct investment.

“Ownership is the new endorsement contract.”

4. New Asset Classes: Where the Growth Is

In 2025, a new set of asset classes is setting the agenda, with growth rates and engagement that outstrip traditional clubs and leagues.

Narrative drivers:

Women’s sport surpassed $2.7B in sanctioned league valuations in 2025, with NWSL and WNBA driving $540M+ in media rights and sponsorships this year alone.

Esports hit $4.8B in annual monetised revenues; more than $2.2B came from APAC.

The IPL franchise cricket ecosystem now exceeds $18.5B in system value, with owners delivering cross-league capital flows to MLC (U.S.), SA20 (Africa), and The Hundred (UK).

New tech and DTC platform verticals (Overtime, Tonsser, TGL, Formula E, SailGP) have raised over $2B in new VC/PE over the last 18 months, and platform user bases have grown 20–35% YoY.

“The next investable leagues are platforms for new capital, new fans, and new tech.”

5. Macro, Risk, and Performance: The New Portfolio Logic

The “hedge” case for sport is no longer speculative, it’s proven by the numbers.

Franchise IRR has averaged 8–12% for major leagues since 2020, with some top exits (Chelsea, IPL, NFL) delivering 3–5x original capital.

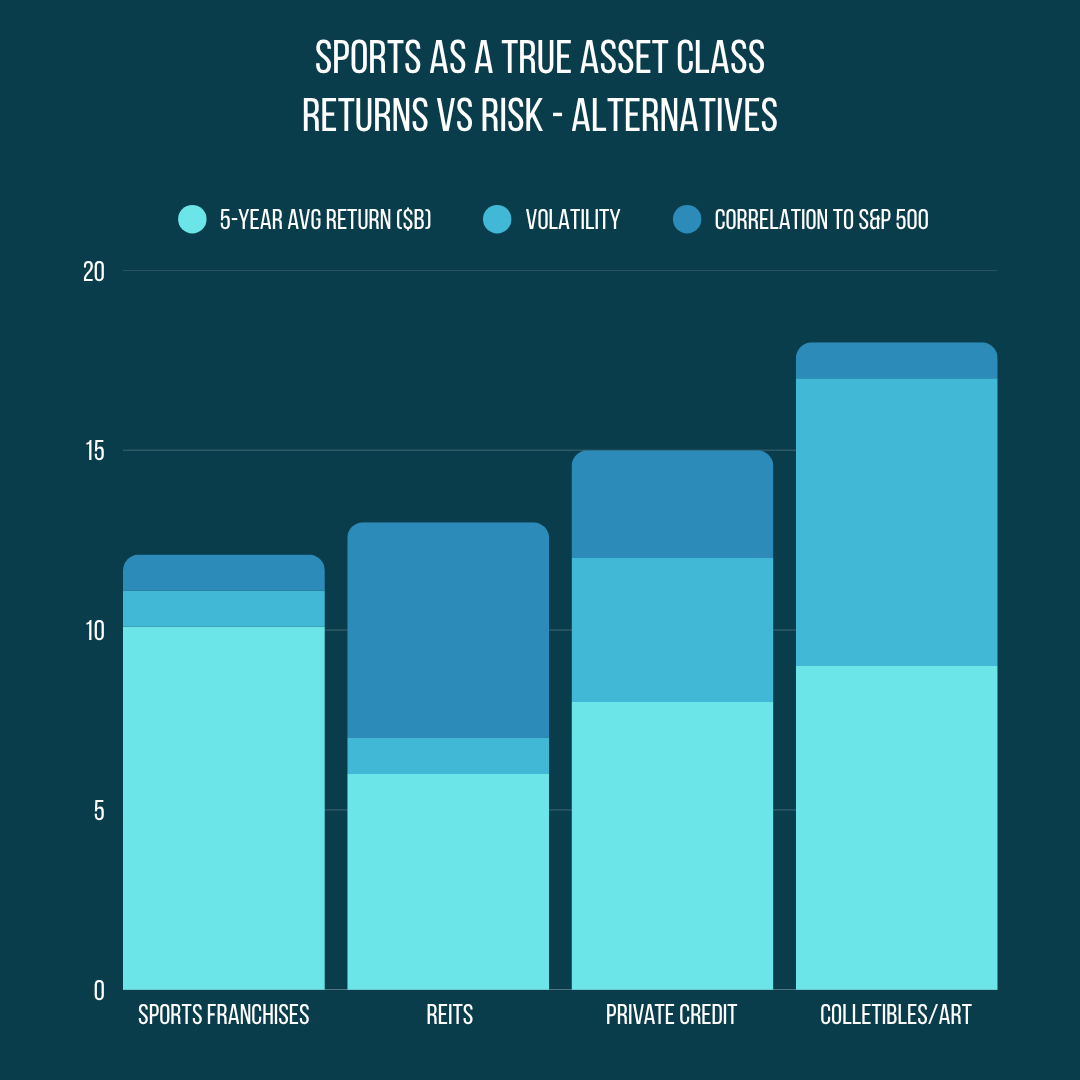

Volatility is consistently lower than REITs or PE; sports’ correlation to the S&P 500 sits at just 0.08, making it an effective diversifier.

Sponsorship, media rights, and local event spending accounts for $115B+ in 2025, with resilient, contractually obligated cash flows buoying the industry even in mixed macro conditions.

Key risks to monitor:

Rights “compression” outside the Tier 1 leagues; cost pressures and regional wage inflation (notably Europe and India); and rising scrutiny for sovereign/PE control.

Gross exits are expected to reach $10B in 2025 as PE and sovereign windows open further, with holding periods stabilising and global recap/secondary markets maturing.

Final Word:

As we enter Q4 of 2025, sports is no longer a mere passion. It’s an engineered, diversified, yield-producing asset class, defined by institutional rigor, growth ambition, and community anchoring that gives it an intrinsic advantage over nearly every other alternative.